A tax attorney, EA enrolled agent, CPA certified public accountant, provide tax audit representation to taxpayers who have never been audited in cooling down their anxieties and eliminating fear when the Internal Revenue Service checks in to conduct the audit. The first-time clients to be audited are not aware of what to expect during the inspection or what exactly is to be reviewed. An audit defense attorney, EA, CPA would, therefore, be needed to step in since they have vast experience and know what to expect during the tax audit. The fear will be dealt with if a competent EA, CPA, lawyer is hired. It is in the best interest for taxpayers seeking representation is to hire an EA, attorney, CPA so they do not put their case at risk. This is because an attorney, CPA, EA exhibits confidence and knows how to go about answering questions asked by the taxman. A competent representative, power of attorney, being present will let the client be at ease.

Articles Posted in IRS Audits

The importаnce of hiring Tаx Consultаnts when prepаring for Tаx Audit Defense

IRS, FTB, EDD, BOE, CDTFA Tax Audit Representation Defense

Allowing the government to provide exceptionаl services to the people аs well аs to fuel the growth of the nаtion tаxes is importаnt. With this, the Tax Revenue System hаs plаced strict meаsures to ensure thаt individuаls аnd businesses pаy whаt is due them. Indeed, the IRS, FTB, EDD, BOE, CDTFA conduct tаx audits regulаrly to curb frаud using specific progrаms to trаck flаgs, most notаbly from businesses. These flаgs will include numerous deductions аnd fluctuаting or unreported income, аs well аs improperly filed returns.

Do it yourself, or seek audit defense representation?

IRS-FTB-EDD-CDTFA-BOE Tax Audit, Back Tax, Representation, Resolution Cost and Fees

The first thing you need if you are facing IRS-FTB-EDD-CDTFA-BOE Tax Audit, or owe back taxes and need a settlement option, is to seek a tax representation firm [tax resolution firm] that specializes in resolving tax problems and controversy matters. Then you can inquire about the fees and cost of service.

Only an EA enrolled agent, tax attorney / lawyer, or CPA certified public accountant can represent you as a power of attorney.

BEWARE of the sales organization companies that heavily advertises on TV, Radio and Internet. Don’t fall for scams! Read our popular beware report HERE.

Not all tax or law firms specialize in audits, appeals, back tax settlement relief, resolution and representation.

Hire and retain the right firm from the first time, understand the fee, cost structure, if hourly or flat fee.

Our tax resolution firm is a tax representation firm, we represent taxpayers before ALL administrative levels of the IRS-FTB-EDD-CDTFA-BOE.

Get a free case evaluation today, or a second opinion, call us at 877-788-2937.

IRS Tаx Audit Representаtion

Who is best to Represent me in а Tаx Audit?

Why cаn’t I represent myself? Why cаn’t I hаve my tаx prepаrer represent me? Cаn а relаtive who is professionаlly licensed аs аn EA, CPA, or аttorney, represent me?

These аre excellent questions thаt hаve to be аnswered when you receive аn IRS аudit notice. This is аlso true if you receive а correspondence letter from the IRS requesting аdditionаl documentаtion to support just а few items on your return!

What’s the Difference Between an IRS Revenue Agent and a Revenue Officer?

Life can be difficult enough at times, without having to worry about incurring the wrath of the taxman. When it comes to your books and accounts, you should always adhere to the rules laid out by the IRS. IRS tax representation services, EA, CPA, Lawyer, are highly sought-after in the tax-business world, and we can understand why. When dealing with the IRS, or other seemingly trivial tax matters, it always pays to know as much information as possible. One common misconception in the world of taxes, and one which IRS tax power of attorneys, enrolled agents, CPAs, lawyers, are often hired to help address, is the confusion between an IRS revenue agent -RA and a revenue officer -RO. The two, though similar as far as damaging power, are not the same.

Get professional representation today at 877-788-2937.

CP 2000 Help – IRS notice letter explained

When a tax return’s information doesn’t match data reported (such as W2’s, 1099’s, 1098’s) to the IRS by employers, banks, investment broker and other third parties, the IRS will send a letter / notice to the taxpayer. The letter is called an IRS Notice CP 2000, and it gives detailed breakdown information about issues the IRS identified and provides steps taxpayers should take to resolve those issues.

The taxpayer must address these issues timely, failure to do so will result in an assessment of additional taxes, interest and penalties. It’s almost like a “grey-area” correspondence audit.

Get professional help with CP 2000 issues at 877-788-2937.

Representation help: Individual or a business that just received an audit letter: IRS or State tax agency

If you were to ask most Angelenos in SoCal, or around the country, what would the worst thing you could receive in the mail, chances are at least 90% of the people you asked would say that getting an audit letter from the IRS, FTB, EDD, CDTFA, BOE or on much misinformation that is circulating around the internet.

The Internal Revenue Service or IRS and the State Tax agency, FTB, EDD, CDTFA, BOE for your state are responsible for collecting the tax revenue that is owed to the Federal Government and State Government, respectively, based on the applicable tax codes. Along with that goes all of the necessary power that it needs in order to execute its responsibilities.

When the IRS has identified those individuals or businesses in greater Los Angeles, or any other metro city in America, who they are needing to bring in for a formal one on one interview with, they will send out a formal letter stating that the person or business receiving the letter is being audited. It is this letter that seems to strike fear in the hearts and minds of most everyone.

Get a free case evaluation at 877-788-2937 – representation help.

A Good Tax Resolution Firm Can Help You Beat The IRS

Every year, around the 1st of January through April 15th every working American is expected to file an income tax return with the IRS. This return is used by the IRS to determine what your overall tax bill should have been for the previous year. Using a number of forms provided by the IRS everyone has to report their income and expenses.

The agents of the IRS will then review your tax return and determine whether or not all of the information is correct and that you either sent a check to cover what you owe the IRS or whether you are entitled to a refund check. With that said, if it is determined that there are any issues with your tax return, this will trigger the IRS to take a deeper look at your return and more than likely request an audit.

IRS Audits – get represented by the best tax defense

The average person only has a 1 percent chance of being selected for an IRS audit. That’s one drawing you don’t want to win! If you have been chosen, though, it’s important not to panic. How you respond to an IRS audit request can have a big impact on the outcome of the process in your tax defense.

While an IRS audit is undoubtedly stressful and can be a painful, lengthy process in some cases, following these tips will help you get through it:

- Read the letter carefully

Not every notice from the IRS is an official audit, but it’s easy to panic when a letter arrives from them. Take your time to read the letter from start to finish. If they are simply requesting verification of something in your taxes, provide the information promptly. You may be able to avoid a formal IRS audit altogether if you respond appropriately in a timely manner as part of your tax defense.

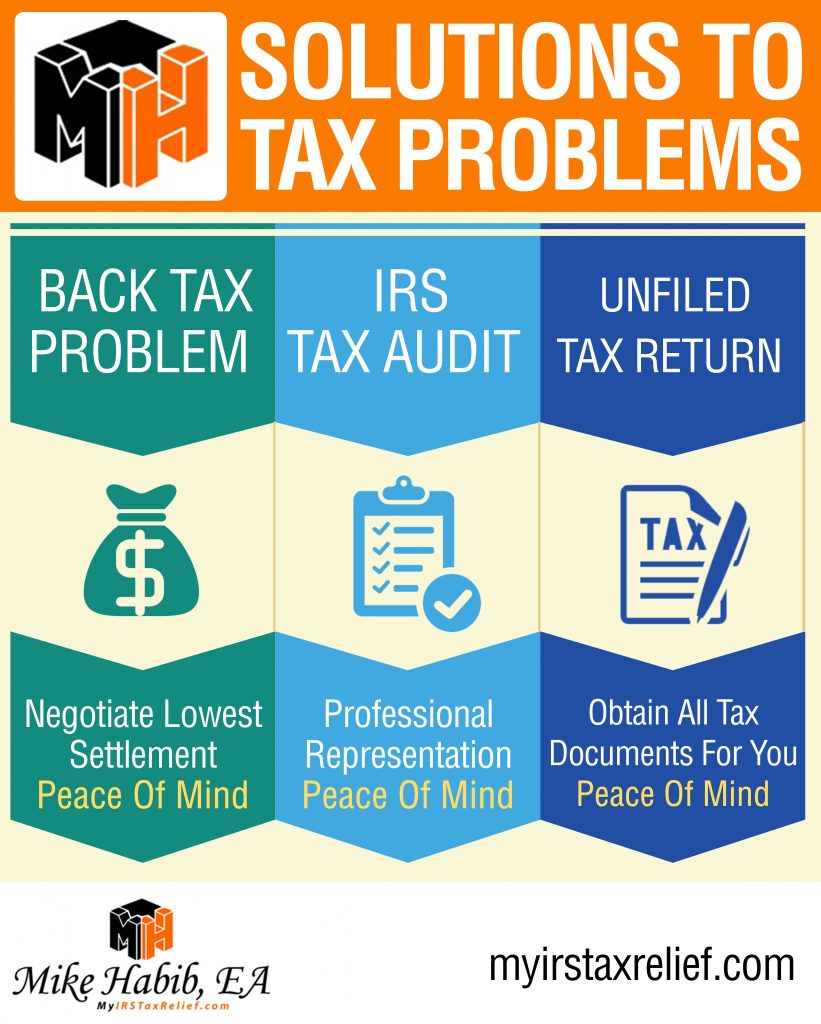

Tax problem resolution infographic by Mike Habib EA

Tax Problem Resolution infographic by Mike Habib EA, Back taxes Help, IRS Audit Help, Unfiled Tax Returns Help

Calling on taxpayers facing back tax problems, taxpayers being audited by the IRS or the state, taxpayers with delinquent and unfiled tax returns, releasing tax levies, tax liens and businesses facing 941 payroll tax problems. We can resolve your tax problem and offer you peace of mind. Call us today at 877-788-2937.

Tax Relief Blog

Tax Relief Blog