Fresh start – tax forgiveness program – as advertised on radio, TV, internet

Taxation can be a complicated and stressful matter, particularly when it comes to tax levies and liens. If you are facing a tax issue, it is important to understand your rights and how to navigate the complex tax system. In this comprehensive FAQ, we will explore the ins and outs of tax levies and liens, and how Mike Habib, EA a tax relief professional can help you resolve your tax issues.

Q: What is a tax levy (garnishment/attachment)? IRS-FTB-CDTFA-EDD

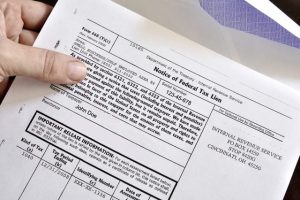

A: A tax levy is a legal action taken by the government to seize assets in order to pay a tax debt. This can include garnishing wages, levying bank accounts, and other property, such as a house or car. A tax levy is different from a tax lien in that it is a direct seizure of assets, whereas a lien is a claim on assets that must be paid off before the property can be sold.

Tax Relief Blog

Tax Relief Blog