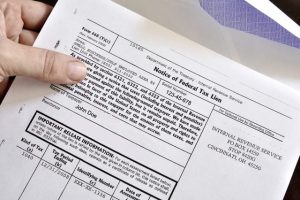

Are you receiving calls, postcards and letters regarding your IRS tax lien? Are telemarketers bombarding you with telephone calls to settle your back tax debt?

BEWARE!! IRS Lien letter recipients!

Many of these solicitors you are not actually licensed to represent you before the IRS, they are not tax attorneys, nor CPAs, nor EAs.

See our popular “beware report” HERE.

Learn about the IRS fresh start initiative program below.

The IRS is actively and aggressively pursuing individual and business taxpayers with aggressive collection actions. IRS enforcement could be in the form of a tax lien, where the IRS files a lien at your county recorder’s office as a public record so the taxpayer cannot sell assets or property without paying their taxes, penalties and interest.

The IRS also enforces collection actions through tax levy and tax garnishment actions against the taxpayer paycheck and bank accounts. Taxpayers should avoid these enforcement actions by resolving their back tax matter with the IRS.

IRS Lien letter recipients: Get tax help today! IRS Fresh Start program helpline 877-788-2937. All 50 states.

Continue reading ›

Tax Relief Blog

Tax Relief Blog