TIGTA identified 685,555 taxpayers who had a balance due as of May 14, 2019. These taxpayers reported adjusted gross income (AGI) of $200,000 or more and owed a combined total of $38.5 billion. Because the IRS prioritizes high balance due cases for collection, many of these high-income taxpayers would be included in high-priority work. However, balance dues are not prioritized by incomes earned and some improvements could be made to prioritize high-income taxpayers more effectively. A separate IRS analysis of 64,317 delinquent tax cases showed that the IRS collected less than 50 percent of tax debt owed by these high-income taxpayers within 52 weeks of assignment to Field Collection. The following chart shows that taxpayers having an average AGI of over $1.5 million paid the IRS an average of 39 percent of what they owe. While 39 percent is more than what the IRS predicted it would collect, these high-income taxpayers still owed over $2 billion.

Average AGI of Taxpayers in This Group Balance Due Actual Recovery Rate Remaining Balance Due $1,563,390 $4,009,955,107 39% $2,442,387,519 $98,289 $1,089,010,998 17% $906,586,760 $24,985 $1,157,135,371 12% $1,014,227,292

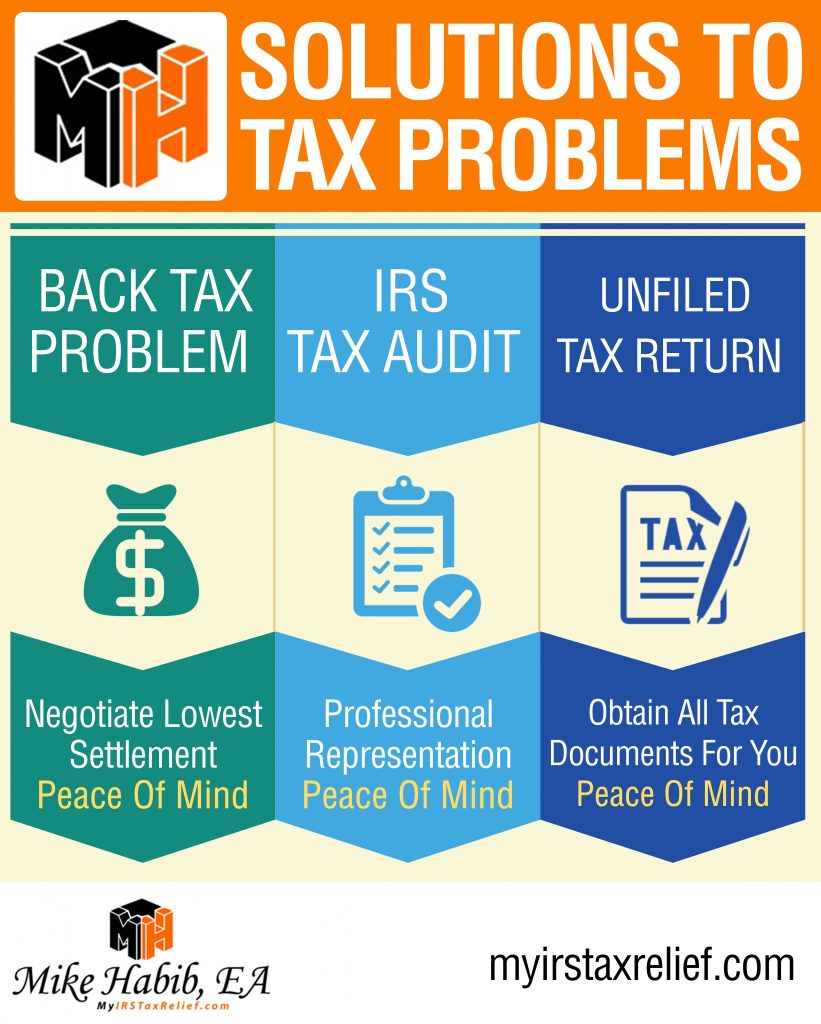

Get proper representation by power of attorney 1-877-788-2937.

Tax Relief Blog

Tax Relief Blog