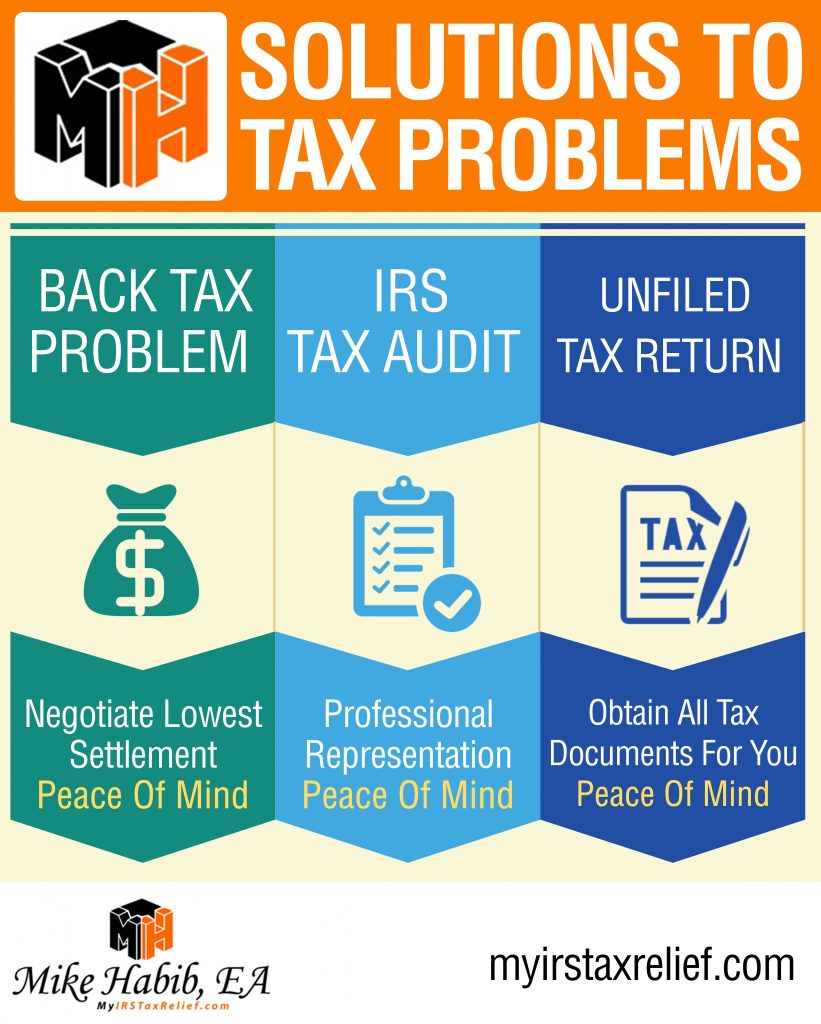

We help individual and business taxpayers facing tax problems such as IRS-FTB-EDD-CDTFA-BOE tax audits, back tax debt, unfiled tax returns, employment 941 payroll problems in greater areas of Upland, Claremont, Rancho Cucamonga, Fontana, Ontario in California.

Tax problems don’t go away, you must take action to avoid tax levies such as bank levies, and wage garnishments. The IRS-FTB-EDD-CDTFA-BOE can also file tax liens against your properties in Upland, Claremont, Rancho Cucamonga, Fontana and Ontario.

Don’t let the tax agency ruin your life! Get tax relief today at 877-788-2937.

Tax Relief Blog

Tax Relief Blog